Fuel Your Finances: Sip Your Coffee as AI Revolutionizes Financial Banking

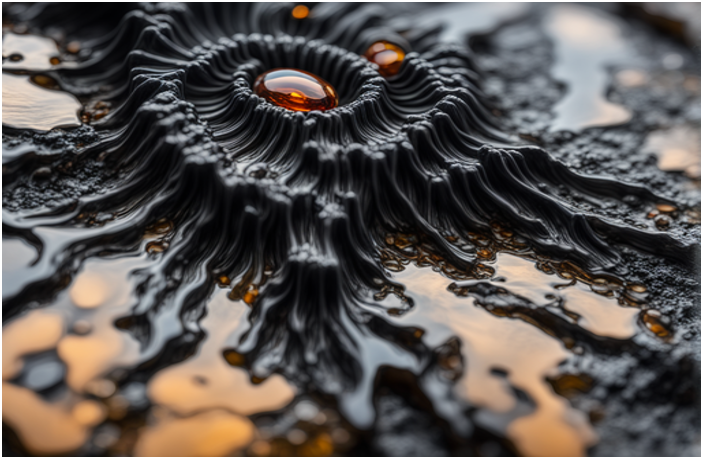

Precision Delivery Systems: Robotic Slime at the Heart of Medication Innovation One of the most exciting applications of Robotic Slime in medicine lies in precision drug delivery. Imagine a scenario where tiny robotic particles, embedded in a gel-like substance, navigate the human body with remarkable precision, delivering medication exactly where it’s needed. It’s not science…

Data Analytics Sorcery: AI, our modern market wizard, analyzes vast datasets of recent sales, market trends, and local whispers, unraveling the clues to forecast the future dance of housing prices. Economic Insights: The AI processes economic data – job statistics, income trends, and economic vibes – to predict how the economy’s magical strength might influence…

Question 1: What is the primary function of the TensorFlow Hub? A. To store and share pre-trained machine learning models B. To deploy machine learning models on edge devices C. To visualize and understand machine learning models D. To manage machine learning datasets Question 2: Which Google Cloud Platform product is used for speech recognition…

Hi techies, it’s time to upgrade yourself with AI! From beginners to advanced learners, these curated courses will guide you through the fascinating world of artificial intelligence, enabling you to leverage AI for career growth and innovation. Here’s a deeper dive into what each course covers: GenAI for Beginners This course simplifies the concept of…

Introduction: The Evolution of Prosthetics Meets AI The field of prosthetics has witnessed a transformative shift with the integration of AI into robotic limb technology. Traditional prosthetics, while serving a crucial purpose, often lacked the nuanced responsiveness seen in natural human movement. Enter AI, the catalyst for a new era in which prosthetic limbs not…

The Busy Bee Helpers: Guess what? AI is like a super helper, doing lots of jobs really fast. It helps send emails, posts on social media, and does many other tasks, freeing up time for humans to dream up even cooler stuff! Chatty Robots and Super-Fast Friends: Meet AI-powered chatbots, our new digital buddies! These…